#Stochastic indicator strategies

Explore tagged Tumblr posts

Text

Mastering Trading with the Stochastic Indicator: A Comprehensive Guide

Introduction Stochastic In the realm of financial markets, successful trading requires a deep understanding of various technical indicators. Among these tools, the Stochastic Oscillator stands out as a powerful tool for identifying potential trend reversals and overbought or oversold conditions in the market. In this comprehensive guide, we will delve into the intricacies of the Stochastics…

View On WordPress

#Bearish Divergence#Bullish and bearish divergences#Bullish Divergence#Crossover Strategy#Momentum Indicators#Overbought and oversold conditions#Overbought Oversold#Risk Management#Risk management in trading#Stochastic#Stochastic crossover strategy#Stochastic indicator strategies#Stochastic Oscillator#Stochastic trend confirmation#technical analysis#Trading Strategies#Trading with Stochastics#Trend confirmation

0 notes

Text

Momentum Trading: Forex Trading Strategy Explained

Momentum trading is a strategy that seeks to capitalize on the continuance of existing trends in the market. By focusing on the strength of price movements, traders can make informed decisions and optimize their profits. What is Momentum Trading? Momentum trading involves buying and selling currency pairs based on recent price trends. The core idea is that strong movements in the market tend to…

#Currency Pairs#Divergence#Economic Indicators#Forex#Forex Trading#Leverage#MACD#Market Conditions#Market News#Momentum Trading#Moving Average Convergence Divergence#Moving Averages#Price Movements#Relative Strength#Risk Management#RSI#Stochastic Oscillator#Stop-Loss#Stop-Loss Orders#Take-Profit#Trading Strategy

3 notes

·

View notes

Text

Stochastic, SMI și Stochastic RSI: Ghid Complet pentru Identificarea Condițiilor Extreme și a Schimbărilor de Trend

Stochastic, SMI și Stochastic RSI: Ghid Complet pentru Identificarea Condițiilor Extreme și a Schimbărilor de Trend Introducere În analiza tehnică, indicatorii de momentum joacă un rol esențial în evaluarea condițiilor pieței și în identificarea momentelor de inversare a trendului. Trei dintre cei mai populari indicatori care se bazează pe conceptul de stochastic sunt Stochastic Oscillator,…

#analiza tehnica#strategie de tranzacționare#indicator tehnic#supracumpărare#supravânzare#trend#momentum#Stochastic#Stochastic Momentum Index#SMI#Stochastic RSI

0 notes

Text

good indicators for forex trading

📊 Good Indicators for Forex Trading: The Ultimate Guide for Profitable Trades

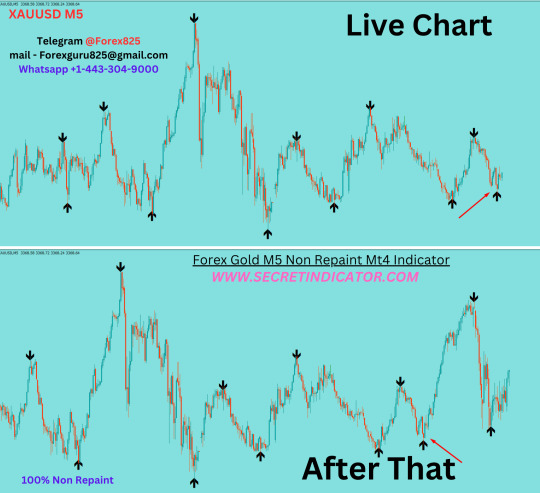

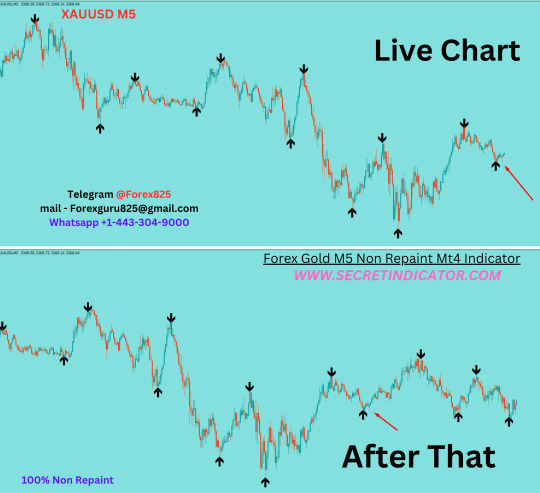

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

✅ Introduction

Forex trading is both an art and a science. While price action and market psychology play key roles, technical indicators help traders make objective, data-driven decisions. Whether you’re a beginner or an experienced trader, choosing the right indicators can dramatically improve your entries, exits, risk management, and profitability.

But with hundreds of forex indicators available — from the classic moving averages to exotic custom tools — how do you know which ones truly work?

This detailed article explores:

What forex indicators do

The core types of indicators

The best and most commonly used indicators

How to use them effectively in combination

Common mistakes and tips for better results

📌 Table of Contents

What Are Forex Indicators?

Types of Technical Indicators

Why Indicators Matter in Forex Trading

The Top 10 Good Indicators for Forex

Deep Dive into the Most Effective Indicators

Best Indicator Combinations

Tips for Using Indicators Effectively

Common Mistakes to Avoid

How to Backtest and Optimize Indicators

Final Thoughts

1. �� What Are Forex Indicators?

Forex indicators are mathematical calculations based on price, volume, or open interest. They analyze past market data to help traders make predictions about future price movements. Indicators are typically plotted on or below a chart and can signal:

Trend direction

Reversal zones

Entry/exit points

Market strength

Volatility

Overbought/oversold levels

They don't predict the future perfectly, but when used correctly, they help you make probability-based decisions.

2. 📊 Types of Technical Indicators

Forex indicators fall into several major categories:

🔹 Trend Indicators

Identify the direction and strength of market trends.

Examples: Moving Averages, MACD, ADX, Ichimoku Cloud

🔹 Momentum Indicators

Measure the speed of price movement to find overbought/oversold areas.

Examples: RSI, Stochastic Oscillator, CCI

🔹 Volatility Indicators

Measure the rate of price fluctuations, showing when the market is quiet or explosive.

Examples: Bollinger Bands, ATR (Average True Range)

🔹 Volume Indicators

Gauge trading volume, often used to confirm the validity of price moves.

Examples: OBV, Volume Oscillator, Chaikin Money Flow

🔹 Custom or Composite Indicators

Combine multiple tools or custom formulas.

Examples: TDI (Traders Dynamic Index), Supertrend, Pivot Point Indicator

Each type has a purpose. Great trading strategies usually combine 2–3 different types.

3. 🧠 Why Indicators Matter in Forex Trading

Trading without indicators is like driving without a speedometer or GPS — possible, but risky and uncertain.

Good indicators help:

Define trading rules

Add objectivity to decision-making

Reduce emotional trading

Confirm entries and exits

Prevent overtrading in choppy markets

Identify trends early or avoid weak ones

They don’t guarantee success — but they increase your statistical edge.

4. ✅ The Top 10 Good Indicators for Forex Trading

Here are ten indicators that are time-tested, effective, and widely used by traders across all levels: RankIndicatorTypeUse Case1Moving Averages (EMA/SMA)TrendIdentify direction and smooth price2Relative Strength Index (RSI)MomentumSpot overbought/oversold areas3MACDTrend/MomentumSignal trend changes via crossovers4Bollinger BandsVolatilityBreakout signals, range bounds5ADXTrend StrengthMeasure trend strength (not direction)6Stochastic OscillatorMomentumShort-term reversal entries7ATRVolatilitySet dynamic stop-loss based on volatility8Ichimoku CloudTrendComplete trend system with signals9Fibonacci RetracementSupport/ResistanceIdentify pullback and entry zones10Volume Indicators (OBV/CMF)VolumeConfirm trends and breakouts

Let’s now explore some of the best ones in detail.

5. 🔍 Deep Dive: Best Indicators Explained

🔹 1. Moving Averages (EMA & SMA)

Simple Moving Average (SMA): averages price over a period.

Exponential Moving Average (EMA): gives more weight to recent prices.

Popular Uses:

50 EMA & 200 EMA crossovers = trend change

Price above 200 EMA = long bias, below = short bias

Use slope of EMA for trend strength

Pro Tip: Use moving average channels for dynamic support/resistance.

🔹 2. Relative Strength Index (RSI)

Ranges from 0 to 100

Above 70 = Overbought (possible sell)

Below 30 = Oversold (possible buy)

How to Use:

Divergence between RSI and price = strong reversal signal

Combine with support/resistance zones

Use RSI > 50 in uptrends, < 50 in downtrends

🔹 3. MACD (Moving Average Convergence Divergence)

Consists of:

MACD line (12 EMA – 26 EMA)

Signal line (9 EMA of MACD)

Histogram (difference between MACD and signal)

Strategy:

MACD line crossing above signal = buy signal

Use MACD divergence to detect early trend reversals

🔹 4. Bollinger Bands

3 lines: Upper, Middle (SMA), Lower band

Bands widen with volatility, contract in calm markets

Trading Ideas:

Price touches lower band + oversold RSI = potential long

Breakout with volume = trend beginning

Range-bound strategy: buy at lower band, sell at upper

🔹 5. ADX (Average Directional Index)

Measures trend strength, not direction

Value > 25 = trend is gaining momentum

Value < 20 = market is ranging

Combine with:

+DI and –DI lines to see bull vs bear strength

Trendline or MA to confirm direction

🔹 6. Stochastic Oscillator

Two lines: %K and %D

Values > 80 = overbought, < 20 = oversold

How to Trade:

Buy when %K crosses above %D in oversold zone

Sell when %K crosses below %D in overbought zone

Best in ranging or corrective phases

🔹 7. ATR (Average True Range)

Measures volatility, not direction

Use for:

Setting realistic stop-losses based on market behavior

Filtering out low-volatility trades

Adjusting position sizing dynamically

🔹 8. Ichimoku Cloud

A complete system: trend, momentum, and future resistance zones

Components:

Kumo Cloud: dynamic S/R

Tenkan & Kijun: short-term trend crossovers

Chikou Span: lagging confirmation

Works best on H4 and D1 timeframes.

🔹 9. Fibonacci Retracement

Tool based on key price ratios (0.382, 0.5, 0.618)

Great for pullback entries in trends

Strategy:

Price retraces to 61.8% + MA support = strong long setup

Combine with candle signals or trendline breaks

🔹 10. Volume Indicators

OBV (On-Balance Volume): volume flow

Chaikin Money Flow: volume + price pressure

Use them to:

Confirm breakouts

Spot early accumulation/distribution

Add strength to RSI/MACD setups

6. 🔗 Best Indicator Combinations

No single indicator is perfect. Here are some powerful combos:

✅ RSI + Bollinger Bands

RSI confirms overbought/oversold

BB shows volatility edge

✅ ADX + Moving Averages

MA shows direction, ADX confirms trend strength

✅ MACD + Volume

MACD gives direction change

Volume confirms if it’s real

✅ Stochastic + Fibonacci

Stochastic entry after Fib retracement level

Always look for confluence of signals before entering a trade.

7. 🧠 Tips for Using Indicators Effectively

Use indicators to confirm, not control decisions

Stick to 2–3 indicators max — don’t clutter your chart

Adjust indicator settings based on timeframe and strategy

Use support/resistance and candlestick patterns as base context

Watch for divergence for early reversal warnings

8. ❌ Common Mistakes to Avoid

Over-reliance on indicators

Using too many conflicting tools

Not backtesting indicators

Ignoring market context

Trading all signals — not all are valid

Remember: Indicators follow price, not the other way around. Context is king.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex factory#forex market#forex education#forex online trading#forex broker#crypto#forex news#forex#forex indicators#forex ea

0 notes

Text

Unlocking the Power of NinjaTrader 8 Indicators for Smarter Trading

When it comes to effective trading, having the right tools can make all the difference. NinjaTrader 8 indicators are among the most powerful tools available to traders today, offering enhanced market insights and precise signals to improve decision-making. Whether you’re a beginner or a seasoned trader, understanding and using NinjaTrader indicators effectively can significantly boost your trading performance.

What Are NinjaTrader 8 Indicators?

NinjaTrader indicators are custom-built tools that work within the NinjaTrader platform, designed to analyze market data and provide signals about price trends, momentum, volatility, and potential entry or exit points. NinjaTrader 8, the latest version of the platform, offers improved capabilities, faster processing, and more flexibility for developing and using indicators compared to its predecessors.

These indicators can range from simple moving averages and RSI (Relative Strength Index) to more advanced, proprietary indicators tailored for specific trading strategies. NinjaTrader 8 indicators allow traders to customize their charts and trading systems to better fit their style and goals.

Benefits of Using NinjaTrader 8 Indicators

Improved Accuracy

NinjaTrader indicators help filter out market noise, providing clearer signals. This precision allows traders to identify trends earlier and react quicker, reducing the chances of false entries or exits.

Customization

With NinjaTrader 8’s advanced architecture, indicators are highly customizable. Traders can adjust parameters, combine different indicators, or even develop their own to suit their unique strategies.

Versatility Across Markets

NinjaTrader indicators work seamlessly across multiple asset classes, including stocks, futures, forex, and cryptocurrencies. This versatility means traders can maintain consistency in their analysis regardless of their trade market.

Automation and Strategy Integration

Many NinjaTrader indicators integrate directly with the platform’s automated strategy builder. This feature allows traders to automate trades based on indicator signals, removing emotion from the trading process and enabling faster execution.

Popular Types of NinjaTrader indicators

Trend Indicators: Tools like moving averages, supertrends, and ADX help identify the direction and strength of price trends.

Momentum Indicators: Indicators such as RSI, Stochastics, and MACD measure the speed and magnitude of price movements.

Volatility Indicators: ATR (Average True Range) and Bollinger Bands help assess market volatility and manage risk.

Custom Renko Indicators: Specialized tools designed for Renko chart users that filter noise and provide clear trend signals.

Why Choose NinjaTrader Indicators?

NinjaTrader indicators are favored because they combine ease of use with powerful analytical features. The platform supports a large community of developers, meaning a wide range of free and paid indicators are available. NinjaTrader’s active user base also shares ideas, scripts, and improvements, keeping the ecosystem dynamic and innovative.

Using NinjaTrader 8 indicators can provide an edge by helping traders make informed decisions with real-time data and signals. Whether you want to identify breakout points, confirm trend reversals, or gauge momentum, these indicators can be invaluable in your trading toolkit.

Source: https://trandingdailynews.com/unlocking-the-power-of-ninjatrader-8-indicators-for-smarter-trading

0 notes

Text

How to Use Technical Indicators Effectively in Trading

Technical indicators are powerful tools that can help traders analyze market trends, predict future price movements, and make more informed trading decisions. Whether you're a beginner or an experienced trader, understanding how to use technical indicators effectively can significantly improve your trading strategy.

In this article, we’ll explore how to use technical indicators in a way that maximizes their potential and helps you make better trading decisions.

1. Understand the Types of Technical Indicators

Technical indicators come in various forms, and they can generally be divided into three categories:

Trend indicators: These indicators help you identify the direction of the market trend. Examples include Moving Averages, Average Directional Index (ADX), and Moving Average Convergence Divergence (MACD).

Momentum indicators: These help you measure the strength of a price movement and can signal overbought or oversold conditions. Common examples are the Relative Strength Index (RSI) and Stochastic Oscillator.

Volume indicators: These indicators provide information about the strength of a price move based on trading volume. Examples include On-Balance Volume (OBV) and Chaikin Money Flow (CMF).

Understanding the different types of indicators and their purposes is the first step in using them effectively. Each indicator serves a specific role and can be used in combination with others to confirm signals.

2. Choose the Right Indicators for Your Strategy

There are hundreds of technical indicators available, but using too many can lead to confusion and conflicting signals. It’s important to choose the right indicators that align with your trading style and strategy.

For example:

If you’re a trend-following trader, focus on indicators like Moving Averages and MACD that help you identify and confirm the direction of the market trend.

If you’re a momentum trader, focus on indicators like RSI and Stochastic Oscillator to spot potential overbought or oversold conditions and identify reversal points.

If you trade based on volume, use OBV or Chaikin Money Flow to understand the strength behind price movements.

By selecting indicators that suit your strategy, you can streamline your analysis and avoid overloading your charts with unnecessary information.

3. Use Multiple Indicators to Confirm Signals

One of the best ways to use technical indicators effectively is to combine them for confirmation. Relying on a single indicator can sometimes lead to false signals or misleading information. By using multiple indicators, you can confirm the accuracy of your analysis and reduce the chances of making poor decisions.

For example:

Combining trend and momentum indicators: If your Moving Average shows an uptrend, and the RSI is not in the overbought zone (typically above 70), this could confirm that the uptrend is still strong and likely to continue.

Using volume with price action: If a breakout occurs, and the OBV indicator shows increased volume, this can confirm the breakout as a valid signal rather than a false move.

By confirming your analysis with different indicators, you increase the reliability of your trading signals.

4. Understand the Limitations of Indicators

While technical indicators are useful, they are not infallible. Each indicator has its own strengths and weaknesses, and relying solely on indicators without considering other factors can lead to losses.

Some limitations of technical indicators:

Lagging nature: Most technical indicators are lagging indicators, meaning they are based on past price action and can be slow to react to current market conditions. For instance, Moving Averages may only show a trend after it has already started.

False signals: Indicators can sometimes provide false or conflicting signals, especially in volatile markets. For example, an RSI showing an overbought condition during an uptrend may be misleading if the trend continues to gain momentum.

Overcomplication: Using too many indicators can lead to analysis paralysis. You may start receiving conflicting signals from different indicators, which can cloud your decision-making.

To avoid these limitations, always use indicators in conjunction with price action, support and resistance levels, and other forms of analysis. This holistic approach helps reduce the risk of relying too heavily on any single indicator.

5. Use Indicators to Set Entry and Exit Points

Technical indicators can be valuable tools for setting entry and exit points. By using indicators in combination with your risk management strategy, you can determine when to enter or exit a trade with greater precision.

For example:

Entry points: A bullish crossover between a short-term and long-term moving average could indicate a buying opportunity.

Exit points: An overbought RSI (above 70) or a bearish candlestick pattern could indicate a good time to exit a long position or take profits.

Setting clear entry and exit rules based on indicator signals can help you trade systematically, reducing emotional decision-making and increasing consistency.

6. Practice and Refine Your Indicator Usage

Like any tool, the key to using technical indicators effectively is practice. Spend time experimenting with different indicators and combinations on historical data to see how they perform in various market conditions. You can also backtest your strategies using past price data to assess the effectiveness of your chosen indicators.

As you gain experience, you’ll learn how to adjust your use of indicators based on market conditions, improving your ability to read charts and make better trading decisions.

Final Thought: Maximize the Power of Indicators

Technical indicators are a powerful part of any trader’s toolkit. By selecting the right indicators for your strategy, combining them for confirmation, and understanding their limitations, you can improve your trading decisions and increase your chances of success.

Ready to trade smarter with expert-backed strategies and technical indicators? Download Univest — the SEBI-registered trading app that helps you analyze the market, use technical indicators effectively, and trade with confidence. Get started with a smarter trading strategy today.

0 notes

Text

How to Turn $100 into $1000 with a Custom Forex Trading Bot

The attraction of the Forex market is undeniable – the promise of quick gains, the 24/5 accessibility, and the idea of passive income. For many, the dream of turning a modest $100 into a substantial $1000 seems like a distant fantasy. While it's crucial to approach this goal with authenticity and deep knowledge of the intrinsic risks, a meticulously designed and managed custom forex trading bot can significantly tilt the odds in your favor. This article will examine the journey from a small initial capital to a significant profit, highlighting strategy, risk management, and the usefulness of building your automated trading solution.

Forex Trading Bots?

Forex trading bots, also known as Expert Advisors (EAs), are software programs designed to automate trading decisions and execute trades in the foreign exchange market. They operate based on predefined rules and algorithms, tirelessly researching market data, generating signals, and placing orders without human intervention. The primary appeal lies in their ability to remove emotional biases from trading, execute trades with lightning speed, and operate around the clock, capitalizing on opportunities even when you're not at your desk.

However, it's vital to dispel the myth that bots are "set-and-forget" profit machines. While they offer automation, their success hinges entirely on the quality of their underlying strategy, their adaptability to changing market conditions, and stringent risk management. A poorly designed bot can deplete your capital just as quickly, if not faster, than manual trading.

The $100 to $1000 Challenge: Feasibility and Realistic Expectations

Turning $100 into $1000 represents a 900% return on investment – an ambitious but not impossible feat in the highly leveraged forex market. This goal necessitates a strategy that prioritizes consistent, albeit small, gains and aggressive compounding of profits. It also demands a higher tolerance for risk than would typically be advised for larger capital.

Realistically, achieving such a return requires a combination of factors:

Effective Strategy: A trading logic that genuinely identifies profitable opportunities.

Optimal Risk Management: Protecting your limited capital while allowing for growth.

Compounding: Reinvesting profits to accelerate growth.

Favorable Market Conditions: Periods of clear trends or predictable volatility.

It's crucial to understand that there will be losing trades and drawdowns. The objective isn't to win every trade, but to have a positive expectancy over a series of trades, with winning trades outweighing losing ones in terms of profit.

Designing Your Custom Bot: Key Principles

The heart of your $100 to $1000 journey lies in the intelligent design of your custom trading bot. This isn't about buying an off-the-shelf EA; it's about tailoring a solution to your specific risk tolerance and the market dynamics you aim to exploit.

Strategy Development:

Simplicity is Key: For small accounts, complex strategies can be prone to over-optimization and instability. Start with a straightforward strategy.

Trend Following: Often effective for capturing significant moves. Your bot could identify strong trends using moving averages (e.g., crossing of short-term and long-term MAs) or ADX.

Breakout Strategies: Bots can be programmed to identify price breaking above or below key support/resistance levels.

Scalping (with caution): While tempting for quick profits, scalping requires extremely fast execution and very tight spreads, which can be challenging with a small account. If considering, focus on high-liquidity pairs.

Technical Indicators:

Choose a few reliable indicators that align with your chosen strategy. Avoid indicator overload, which can lead to conflicting signals.

Moving Averages (MA): For trend identification and dynamic support/resistance.

Relative Strength Index (RSI) or Stochastic Oscillator: For identifying overbought/oversold conditions, potentially signaling reversals or pullbacks within a trend.

Bollinger Bands: For volatility measurement and potential breakout identification.

Risk Management Parameters (Crucial for Small Accounts):

Fixed Percentage Risk: Crucially, your bot should risk a small, fixed percentage of your account per trade (e.g., 1-2%). This prevents a single large loss from wiping out your capital. As your account grows, the absolute risk amount will increase, allowing for larger position sizes.

Stop-Loss (SL): Every trade must have a predetermined stop-loss to limit potential losses. This is non-negotiable for automated trading.

Take-Profit (TP): Set realistic take-profit targets. Consider using a trailing stop-loss to lock in profits as the price moves in your favor.

Maximum Daily Drawdown: Implement a hard stop for the bot if it experiences a certain percentage drawdown in a single day (e.g., 5-10%). This prevents catastrophic losses during unexpected market events.

Position Sizing: The bot must automatically calculate position size based on your fixed percentage risk and the distance to your stop-loss.

Backtesting and Optimization:

Rigorous Backtesting: Before deploying your bot live, run it against extensive historical data (at least 5-10 years) using high-quality tick data. This simulates how your bot would have performed in the past.

Walk-Forward Optimization: To avoid "over-optimization" (where a bot performs perfectly on historical data but fails in live trading), use walk-forward optimization. This involves optimizing the bot on a segment of data and then testing it on a subsequent, unseen segment.

Realistic Slippage and Commissions: Factor in realistic slippage (the difference between your intended entry/exit price and the actual price) and commission costs during backtesting to get a true picture of profitability.

Platform Selection:

MetaTrader 4 (MT4) / MetaTrader 5 (MT5): These are industry standards for retail forex trading and offer built-in environments (MetaEditor, MQL4/MQL5) for developing and testing EAs. MQL4 (for MT4) and MQL5 (for MT5) are C-like programming languages.

Python: For more advanced users, Python with libraries like MetaTrader5 (for connecting to MT5) or fxcmpy (for FXCM's API) offers immense flexibility for custom bot development, data analysis, and machine learning integration.

Building and Implementing Your Bot

Coding Considerations:

Modular Design: Break your bot's logic into smaller, manageable functions (e.g., calculate_entry_signal(), manage_position(), set_stop_loss()).

Error Handling: Implement robust error handling to gracefully manage unexpected market conditions, connection issues, or incorrect data.

Logging: Ensure your bot logs all its actions (entries, exits, errors, profits/losses). This is invaluable for troubleshooting and performance analysis.

Broker Selection:

Choose a reputable forex broker that supports automated trading and offers competitive spreads, especially on the currency pairs your bot will trade.

Look for brokers with reliable execution and minimal slippage.

Ensure the broker's platform integrates well with your chosen bot development environment (e.g., MT4/MT5).

VPS (Virtual Private Server):

For 24/7 uninterrupted operation, a Virtual Private Server (VPS) is essential. A VPS hosts your trading platform and bot in a remote data center, ensuring continuous execution regardless of your local internet or power outages. This minimizes downtime and missed opportunities.

Managing and Monitoring Your Bot

Even with a fully automated bot, active management and monitoring are crucial.

Live Testing (Demo Account):

Before deploying your bot on a live account, run it on a demo account for several weeks, or even months. This allows you to observe its behavior in real-time market conditions without risking actual capital.

Compare demo performance with backtest results. Discrepancies might indicate issues with your strategy or data.

Performance Analysis:

Regularly review your bot's performance metrics:

Profit Factor: Total gross profit divided by total gross loss (should be >1).

Maximum Drawdown: The largest peak-to-trough decline in your account balance. This is critical for risk assessment.

Win Rate: Percentage of winning trades.

Average Win/Loss: The average profit of winning trades versus the average loss of losing trades.

Sharpe Ratio: Measures risk-adjusted return.

Identify periods of underperformance and analyze why. Markets evolve, and even the best strategies may require adjustments.

Emotional Discipline (Yes, even with a bot):

The bot handles the emotional burden of trade execution, but you still need emotional discipline to stick to your overall plan.

Avoid the temptation to constantly tweak the bot's parameters based on short-term results. Trust your backtested strategy.

Resist the urge to intervene manually unless there's a critical technical issue or a fundamental market shift that invalidates your strategy.

Challenges and Risks

Turning $100 into $1000 with a custom forex bot is challenging and carries significant risks:

Over-optimization: A bot that performs perfectly on historical data but fails in live trading.

Market Regime Change: Strategies that work well in trending markets may fail in choppy or ranging markets, and vice-versa.

Technical Glitches: Software bugs, internet connectivity issues, or VPS problems can disrupt your bot's operation and lead to losses.

Broker Issues: Unfavorable slippage, high spreads, or technical problems with the broker's platform.

Leverage Risk: While leverage amplifies gains, it also amplifies losses. A small account is particularly vulnerable.

Lack of Adaptability: Bots lack human intuition and cannot adapt to unforeseen geopolitical events or fundamental news releases that drastically alter market dynamics.

Conclusion

The journey from $100 to $1000 in Forex with a Forex trading bot development is a testament to meticulous planning, robust strategy development, and unwavering risk management. While the allure of automation is strong, remember that the bot is merely an extension of your pre-defined logic. It's a tool, not a magic bullet.

By focusing on a simple yet effective strategy, implementing stringent risk controls, rigorously backtesting, and continuously monitoring your bot's performance, you can significantly increase your chances of achieving this ambitious goal. However, always be mindful of the inherent risks and never invest more than you can afford to lose. The path to profitable automated trading is paved with continuous learning, adaptation, and a deep respect for the dynamic nature of the forex market.

0 notes

Text

Why Time Series Analytics Matters in Business

In today’s data-driven world, businesses rely heavily on time series analysis to forecast trends, monitor performance, and make data-backed decisions. Whether it’s tracking sales patterns, predicting customer behavior, or managing supply chains, time series analytics provides critical insights by analyzing data points collected over time.

We emphasize the importance of recognizing patterns in stochastic processes, especially when these processes display periodic statistical properties. This deeper understanding helps businesses uncover hidden cycles and optimize for future outcomes.

Business Applications of Time Series Analytics

1. Forecasting and Demand Planning

One of the most practical uses of time series analytics is forecasting. From predicting future sales to estimating inventory requirements, businesses can make informed decisions that reduce waste and improve customer satisfaction.

2. Anomaly Detection and Risk Management

Time series models help detect unusual deviations in data—essential for identifying fraud, operational failures, or market shifts. This proactive approach supports faster response times and mitigates risk.

3. Performance Monitoring and Optimization

By analyzing historical data trends, businesses can evaluate key performance indicators (KPIs) and refine strategies for better outcomes. This includes everything from marketing effectiveness to resource allocation.

Why Cyclostationarity?

We explore the dynamic nature of data that changes over time but exhibits recurring behaviors. Our work goes beyond basic analysis, offering insights into the periodic structures within time series data—empowering smarter, more strategic business decisions.

0 notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

0 notes

Text

Understanding Binary Options: Approaches for Steady Income

Binary options trading has changed into a well-known kind of purchase between equally newbie and also knowledgeable dealers because ease and also prospect of large earnings. As opposed to standard investing strategies, binary alternatives give a repaired go back according to any sure or perhaps simply no proposition. This kind of all-or-nothing method might appear easy, yet steady profitability needs far more as compared to fortune or perhaps guesswork. For anyone looking to learn binary alternatives in the modern energetic industry, a great comprehension of techniques, follower of rules chance supervision, and also emotional handle essential parts. This informative article explores the main element factors and also techniques in which can cause steady income inside binary options trading.

With the central, binary options trading requires predicting whether or not the price tag on any economic property will probably be previously mentioned or perhaps under a certain value with a established expiration moment. The particular property could possibly be anything at all coming from forex pairs and also commodities to be able to indices and also personal stocks and shares. In the event the prediction will be appropriate, the particular speculator will get a hard and fast pay out. When completely wrong, the particular put in sum will be misplaced. Even though the notion is simple, the particular areas usually are not, and also accomplishment needs far more as compared to pure guesswork.

Step one in the direction of steady profitability will be comprehending industry as well as the property getting traded. Binary alternatives are usually inspired from the identical monetary and also complex aspects in which push standard areas. Monetary media, geopolitical activities binary options trading, rate selections, and also business revenue accounts almost all enjoy a critical function inside value movements. Keeping up with international activities and also monetary calendars permits dealers to be able to foresee industry side effects and also help make a lot more educated selections.

Complex examination will be one more essential aspect inside creating profitable techniques. This involves studying maps, discovering styles, and also making use of signals just like relocating averages, help and also level of resistance ranges, and also oscillators including the Comparable Durability Index or perhaps the particular Stochastic Oscillator. Productive dealers usually count on routine reputation and also traditional value habits to determine the almost certainly course of your property. Graph and or chart studying can be a talent in which will take time and energy to produce, nonetheless it will become a robust application regarding ready for short-term value motions any time learned.

Just about the most successful techniques inside binary alternatives will be craze pursuing. This approach requires discovering an obvious craze available in the market and also inserting investments in direction of in which craze. As an example, in case a forex couple continues to be persistently relocating way up, any speculator should spot contact alternatives in the course of pullbacks, planning on the particular craze to be able to continue. This strategy helpful inside areas together with robust directional movements which is most reliable any time validated simply by numerous complex signals.

One more beneficial method will be array investing, which involves discovering price levels in which a great property persistently bounces among help and also level of resistance. In the non-trending or perhaps sideways industry, dealers can easily spot contact alternatives if the value techniques help and also set alternatives around level of resistance. This strategy relies upon the particular forecasts the property can keep on relocating inside of the proven array right up until any breakout takes place.

News-based investing can be a more complex approach that requires inserting investments about considerable monetary posters or perhaps economic activities. These kinds of activities usually cause improved volatility, that may current rewarding options when timed effectively. As an example, job info emits or perhaps key lender posters could cause well-defined value motions. Dealers which comprehend the particular benefits of the activities and also foresee industry effect can easily cash in on around the producing energy.

Although method is very important, simply no method can easily ensure any acquire each and every time. As a result, chance supervision will become the particular cornerstone regarding lasting investing. One of the primary blunders dealers help make will be risking a lot of money about the same business. A standard training between specialists is always to chance simply a small % with the investing consideration about each and every business, making sure no single damage substantially has an effect on the general account balance. This kind of follower of rules method aids dealers put up with shedding streaks and also keep on investing using a stage brain.

One more essential aspect regarding chance supervision will be mental handle. Investing is an mental roller coaster, especially when funds will be on the line. Dread, greed, and also impatience usually cause impulsive selections and also overtrading. Creating mental self-control permits dealers to be able to follow their particular techniques and avoid selections pushed simply by momentary inner thoughts. Keeping any investing log will help on this consider, offering ways to observe efficiency, recognize blunders, and also refine techniques according to genuine final results as opposed to assumptions.

Timing can be a critical consider binary options trading. Selecting the most appropriate expiration moment will make the particular variation among accomplishment and also disappointment. Reduced expirations just like 58 just a few seconds or perhaps several moments demand speedy decision-making and also specific industry examination, although more time expirations enable more hours regarding industry styles to produce. Comprehending the particular habits with the picked property and also aligning the particular expiration moment with all the predicted industry shift increases the possibilities of a prosperous final result.

Lately, computerized investing methods have got obtained reputation inside the binary alternatives area. These kinds of methods carry out investments according to pre-set algorithms and also principles. Although they could lessen mental engagement and let regarding round-the-clock investing, they may be not necessarily foolproof. Dealers need to cautiously examine and also analyze virtually any method just before depending on that, since industry ailments can adjust, and also just what operates beneath a single circumstance may well are unsuccessful beneath one more.

Schooling and also steady studying are usually important to be able to understanding binary alternatives. Areas grow, and also fresh strategies come out on a regular basis. Keeping up to date with all the newest investing techniques, scientific equipment, and also industry skills aids dealers continue to be competing. Several productive dealers allocate moment daily to be able to looking at the particular areas, studying investments, and also researching monetary styles. This kind of steady energy creates a solid base regarding long-term accomplishment.

Having a private investing program will be one more stage in the direction of reaching steady income. This plan should include plainly identified targets, desired resources, chance details, and also investing hrs. Creating a organized method aids sustain emphasis and also self-control, lowering the likelihood of mental or perhaps reactive selections. Dealers which handle binary alternatives being a significant enterprise rather than a video game have a tendency to execute far better as time passes.

Additionally it is crucial that you examine efficiency on a regular basis. Looking at earlier investments, discovering styles inside profitable and also shedding investments, and also studying coming from blunders almost all give rise to progress and also development. Several dealers realize that their particular final results increase substantially when they commence studying their particular efficiency and also creating data-driven modifications with their techniques.

Understanding binary alternatives just isn't concerning running after speedy benefits yet concerning building a steady, methodical way of investing. It needs endurance, self-control, plus a motivation to master coming from equally accomplishment and also disappointment. Even though the binary dynamics with the investing tool presents ease, reaching profitability will be definately not effortless. Nonetheless, those that make investments the particular commitment to know the particular areas, apply successful techniques, and also control chance cautiously can achieve steady income.

The particular quest to be able to mastery inside binary options trading will be certainly one of steady development. Each business, acquire or perhaps drop, supplies a session. Using a organized program, continuous schooling, as well as the proper attitude, dealers can easily find their way the particular binary alternatives industry together with better self-assurance and also skills. In a surroundings in which returns talent and also self-control, the particular determination to be able to progress will become one of the most beneficial method of most.

0 notes

Text

Assessing the Right Time to Invest in Forex: A Comprehensive Guide

Investing in the foreign exchange (Forex) market can be highly rewarding—but only if you know when and how to enter and exit trades. This guide will walk you through the key steps to assess the optimal time to invest, including understanding trading signals, choosing the right charts, mastering entry and exit indicators, and leveraging technology to stay ahead. Whether you’re a beginner or a seasoned trader, these strategies will help you make informed, logical decisions and minimize risk.

1. Why Timing Matters in Forex Trading

The Forex market operates 24 hours a day, five days a week, with trillions of dollars changing hands daily. Given its continuous nature and high volatility, timing your trades can be the difference between healthy profits and significant losses. Entering at the wrong time may expose you to adverse currency swings, while exiting too early can prevent you from maximizing gains.

A well-timed trade allows you to:

Capitalize on momentum during strong trends

Avoid sharp reversals triggered by economic news

Reduce drawdowns and preserve capital

Improve risk-to-reward ratios on every position

By the end of this article, you’ll have a clear roadmap to pinpoint the best moments to invest and secure consistent returns.

2. Understanding Forex Trading Signals

Trading signals are alerts based on predefined criteria that suggest when to buy or sell a currency pair. They distill vast market data into actionable insights, helping traders spot opportunities without parsing every tick on the chart. Signals can be:

Technical: Generated from mathematical calculations on price and volume (e.g., Moving Averages, RSI, MACD).

Fundamental: Driven by economic events, like interest rate decisions or GDP reports.

Sentiment-based: Reflecting trader positioning and market psychology.

The key is to choose signals that align with your trading style—whether that’s scalping, day trading, swing trading, or longer-term position trading.

3. Selecting the Right Chart and Indicators

Before diving into signals, select a charting platform that offers:

Real-time data feeds for all major and minor currency pairs

Customizable timeframes (from 1-minute to monthly)

Built-in technical indicators and the ability to add custom scripts

Common Forex Charts

Line Chart: Simplest view showing closing prices.

Bar Chart: Displays open, high, low, and close (OHLC) for each period.

Candlestick Chart: Similar to bar charts, but with color-coded bodies—excellent for spotting reversal patterns.

Essential Technical Indicators

Moving Averages (MA): Identify trend direction and dynamic support/resistance.

Relative Strength Index (RSI): Measures overbought/oversold conditions.

Moving Average Convergence Divergence (MACD): Captures trend strength and momentum shifts.

Bollinger Bands: Highlight volatility and potential breakout points.

Stochastic Oscillator: Another momentum tool for spotting reversal zones.

Familiarize yourself with how each indicator behaves across different timeframes. Longer MAs smooth out noise but lag more, while shorter MAs react quickly but can generate false signals.

4. Mastering Entry Signals

An effective entry strategy combines multiple indicators to confirm a high-probability setup. Here’s a step-by-step process:

Trend Confirmation:

Use a 50-period and 200-period MA crossover to determine the primary trend (bullish when 50 above 200; bearish when below).

Momentum Filter:

Check RSI or MACD histogram for momentum alignment. For example, in an uptrend, RSI should be above 50.

Pattern Recognition:

Look for chart patterns (e.g., flags, pennants, head and shoulders) that signal continuation or reversal.

Entry Trigger:

A candlestick pattern (e.g., bullish engulfing) or a break above/below a recent swing high/low.

Volume/Volatility Check:

Confirm with volume spikes or Bollinger Band width expansion to ensure the move is supported by sufficient trading activity.

Example Entry Signal Workflow

Step 1: EUR/USD 4-hour chart shows 50 MA above 200 MA (uptrend).

Step 2: RSI sits at 55, indicating bullish momentum.

Step 3: Price consolidates in a bull flag for three candles.

Step 4: A breakout candle closes above the flag’s top—enter long.

Step 5: Volume increases by 20% above the 20-period average, confirming strength.

5. Optimizing Exit Strategies

Your exit plan is just as important as your entry. There are three common types of exits:

Fixed Stops and Profit Targets:

Predefine a stop-loss level (e.g., 30 pips) and a profit target (e.g., 60 pips) before entering. This guarantees a positive risk-to-reward ratio.

Trailing Stops:

Move your stop-loss in your favor as price advances. Many traders use a moving average or ATR-based trailing stop to capture extended moves.

Limit Exits at Key Levels:

Close positions at significant support/resistance zones or Fibonacci retracement lines.

Short-Term (Scalp/Swing) Exits

For quick trades, focus on “turning points”—repeated short-term patterns that can produce fast reversals. Monitor currency pair swings on 5- to 15-minute charts and set tight limit exits (e.g., 10–15 pips) with equally tight stops.

Real-Time Exit Signals

Many platforms offer real-time alerts—for example, if the MACD line crosses below the signal line or if price breaks below a key moving average. These can automate your exit decisions and reduce emotional bias.

6. Combining Multiple Signals for Risk Aversion

Relying on a single indicator is risky; it can generate false positives or lag behind. Instead, create a signal matrix by:

Overlaying trend, momentum, and volatility indicators

Filtering signals across multiple timeframes (e.g., align a 15-minute entry with a 1-hour trend)

Assigning weights to each signal based on reliability and recent performance

By evaluating multiple Forex signals together, you gain a holistic view of the market and can better anticipate fluctuations. This approach helps you stick to a logical mechanism rather than making random decisions under stress.

7. Leveraging Technology and Alerts

Modern Forex trading thrives on technology. With the right tools, you can analyze markets around the clock and never miss a crucial signal.

Mobile Trading Apps: Execute buy/sell orders and monitor charts on your smartphone—no physical presence required.

Automated Alert Systems: Configure alerts for when indicators meet your predefined parameters (e.g., RSI crosses below 30).

Expert Advisors (EAs): Deploy algorithmic trading systems that scan for signals and place trades automatically.

These innovations ensure that you’re always ready to act on new opportunities, whether you’re at your desk or on the go.

8. Choosing a Reliable Signal Provider

While self-generated signals are ideal, many traders supplement their strategies with professional signal services. To choose a trustworthy provider:

Check Track Record: Look for audited performance over at least six months with clear equity curves.

Read Reviews and Forums: Engage with communities on Forex forums and social media—peer feedback can be invaluable.

Compare Costs vs. Value: Free signals can be high-volume but low-quality, while paid services often offer curated, lower-frequency alerts.

Trial Periods: Opt for services that provide a trial or money-back guarantee so you can test signals risk-free.

Always cross-reference third-party signals with your own analysis to maintain control over your trades.

9. Continuous Research and Education

Forex markets evolve constantly. To stay ahead:

Read Business Newspapers and Magazines: Stay informed on macroeconomic trends that influence currency values.

Participate in Online Forums and Webinars: Exchange ideas with other traders and learn from expert lectures.

Backtest New Strategies: Use historical data and Forex software to simulate performance before risking real capital.

Maintain a Trading Journal: Record each trade’s setup, outcome, and your emotional state to refine your approach over time.

By committing to lifelong learning, you’ll adapt your system to changing market conditions and improve your win rate.

10. Conclusion: Bringing It All Together

Assessing the right time to invest in Forex isn’t about luck—it’s about systematic analysis, disciplined execution, and continuous improvement.

Understand and select the best trading signals for your style.

Choose the right charts and technical indicators.

Master robust entry and exit strategies.

Combine signals across multiple timeframes for enhanced risk aversion.

Leverage technology to automate alerts and execute trades.

Partner with a reputable signal provider, but always validate their calls.

Commit to ongoing research and education to refine your edge.

By following these steps, you’ll position yourself to make well-timed, high-probability trades that align with your goals and risk tolerance. Remember, consistency beats occasional brilliance—stick to your plan, and let your system guide you to long-term success in the Forex market. For more insights: Mastering Forex Trading Psychology: Traits, Emotions, and Mindset for Success Paperback – Large Print, May 20, 2025 by NABAL KISHORE PANDE (Author)

#Forex#TradingSignals#ForexStrategy#ForexIndicators#CurrencyTrading#InvestSmart#MarketTiming#ForexCharts#TradingPsychology#ExitStrategy

0 notes

Text

what are the best indicators for forex trading

Best Indicators for Forex Trading – Ultimate Guide (Overview)

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

1. Moving Averages (MA)

Moving Averages are among the most widely used indicators for identifying the direction of the trend.

Simple Moving Average (SMA): Smooths out price data over a period.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive.

Best use cases:

Spotting trend direction.

Entry/exit points when combined with crossover strategies (e.g., 50 EMA and 200 EMA golden/death cross).

2. Relative Strength Index (RSI)

RSI measures the speed and change of price movements on a scale of 0 to 100.

Overbought: Above 70

Oversold: Below 30

Best use cases:

Identify potential reversals.

Confirm trend strength in combination with price action.

3. Moving Average Convergence Divergence (MACD)

MACD is a momentum-following indicator showing the relationship between two EMAs.

Components: MACD line, Signal line, Histogram

Crossovers and divergences signal trade opportunities.

Best use cases:

Confirm trend direction.

Identify momentum changes.

4. Bollinger Bands

Created by John Bollinger, this indicator consists of a moving average with upper and lower bands set 2 standard deviations away.

Best use cases:

Measure volatility.

Identify potential breakout or reversal areas when price hits the outer bands.

5. Stochastic Oscillator

A momentum indicator comparing a particular closing price to a range of its prices over time.

Readings above 80 indicate overbought conditions.

Below 20 indicates oversold.

Best use cases:

Pinpoint entry points.

Effective in ranging markets.

6. Fibonacci Retracement

Used to identify potential support and resistance levels based on Fibonacci ratios (38.2%, 50%, 61.8%).

Best use cases:

Predict pullback levels.

Combine with trend indicators for optimal entries.

7. Ichimoku Cloud

A comprehensive indicator that shows support/resistance, trend direction, and momentum.

Key components: Kumo (cloud), Tenkan-sen, Kijun-sen, Chikou Span.

Complex but powerful once mastered.

Best use cases:

Full-market overview.

Effective in trending markets.

8. Average True Range (ATR)

Measures market volatility over a period.

Best use cases:

Set stop-loss and take-profit levels.

Identify volatile market conditions.

9. Volume Indicators (On-Balance Volume – OBV)

While Forex is decentralized, tick volume or broker volume helps gauge momentum.

Best use cases:

Confirm breakouts.

Validate trend strength.

10. Parabolic SAR

Used to determine the direction of an asset’s momentum and potential reversal points.

Best use cases:

Effective for trailing stop losses.

Best used in trending markets (not ranging).

Combining Indicators for Best Results

RSI + Moving Average: Confirm reversals in trend direction.

MACD + Bollinger Bands: Catch momentum in volatile periods.

Fibonacci + EMA: Plan entries on pullbacks during strong trends.

Tips for Indicator Use

Don’t rely on a single indicator.

Backtest your indicator strategy.

Use indicators with your trading style (scalping, day trading, swing trading).

Keep your chart clean – 2–3 indicators maximum.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex market#forex education#forex news#forex online trading#forex ea#forex factory#forex broker#crypto#forex indicators

0 notes

Text

Mastering Technical Indicators in Share Market Trading: A Practical Guide

Understanding market movements is essential for turning analysis into profit. Technical indicators offer quantifiable insights into price trends, momentum, and market sentiment key tools in the arsenal of any serious trader. In this guide, Wealth Note walks you through the most impactful indicators and shows you how to integrate them into your strategy for smarter, data-driven decisions.

1. Why Technical Indicators Matter

Technical indicators translate raw price and volume data into actionable signals. Unlike fundamental analysis, which examines company health and macroeconomic factors, these tools focus purely on market behavior. Used correctly, they help you:

Identify trend direction and strength

Pinpoint optimal entry and exit points

Gauge overbought or oversold conditions

Confirm breakout or reversal patterns

By complementing chart patterns with indicator-based validation, traders can reduce emotional bias and stick to a systematic plan.

2. Core Indicators to Know

a. Moving Averages (MA)

Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) smooth out price fluctuations to reveal underlying trends. A common approach is the “golden cross” (short-term MA crossing above long-term MA) as a bullish signal, or the “death cross” for bearish momentum.

b. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements on a 0–100 scale. Readings above 70 suggest overbought conditions, while those below 30 hint at oversold territory. Many Wealth Note students use RSI divergences — where price moves counter to the indicator — to spot potential reversals.

c. Moving Average Convergence Divergence (MACD)

MACD calculates the difference between two EMAs and plots a signal line (its own EMA). Crossovers between the MACD line and signal line often precede shifts in momentum. Histogram bars visualize the distance between these lines, helping traders anticipate accelerating or decelerating trends.

d. Bollinger Bands

Comprising a middle-band SMA and two standard-deviation bands, Bollinger Bands expand and contract based on volatility. Prices touching or breaching the bands can signal overextended moves, while “squeezes” foreshadow volatility breakouts.

3. Implementing Indicators in Your Routine

Achieving proficiency with indicators requires practice and context. Follow these steps to integrate them effectively:

Select a Clear Timeframe: Indicators behave differently across intraday, swing, and positional horizons. Align your indicator settings (e.g., 14-day RSI vs. 6-period RSI) with your trading timeframe.

Use Multiple Indicators Judiciously: Combining trend-following tools (like MA) with momentum indicators (like RSI) provides cross-confirmation. Avoid “analysis paralysis” by limiting yourself to two or three complementary indicators.

Backtest Your Strategy: Before risking real capital, apply indicator rules to historical charts. Wealth Note’s simulated trading platform lets you refine entry and exit criteria under diverse market conditions.

Adjust for Market Regimes: Trending markets favor moving averages, while range-bound environments suit oscillators like Stochastic. Learn to switch indicator emphasis as volatility and trend direction shift.

4. Advanced Indicator Techniques

Divergence Trading: When price makes a new high but an oscillator (RSI or MACD) fails to confirm, it hints at waning momentum and possible reversal.

Volume-Weighted Average Price (VWAP): Especially useful for intraday traders, VWAP shows the average price weighted by volume. Trading above VWAP indicates institutional buying, while below suggests selling pressure.

Custom Scripting: Many platforms allow you to tweak indicator parameters or create hybrid tools ideal for traders seeking an edge beyond standard formulas.

5. Pitfalls to Avoid

Overreliance on Signals: No indicator is infallible. Always consider broader market context, news events, and support/resistance zones.

Chasing Alerts: Impulsive reactions to every crossover or band touch can erode profits. Discipline is key — wait for confirmation and alignment across your chosen indicators.

Ignoring Risk Management: Even the best signals fail occasionally. Always define stop-loss levels and position sizes before entering a trade.

By mastering technical indicators, you bring structure and clarity to your Share Market Trading approach. Remember to choose tools that align with your trading style, backtest thoroughly, and adjust as market conditions evolve. Whether you’re refining intraday tactics or building long-term strategies, Wealth Note’s expert-led courses and hands-on support will help you harness the full power of indicators transforming data into consistent, profitable outcomes in the markets.

0 notes

Text

How to Use Technical Indicators for Better Trade Decisions

Technical indicators are essential tools that traders use to analyze price data, identify trends, and make informed decisions. They help you read the market's behavior and predict future price movements with greater accuracy. By incorporating technical indicators into your trading strategy, you can gain a competitive edge and improve your decision-making process.

Here’s how you can effectively use technical indicators to make better trade decisions.

1. Understand the Basics of Technical Indicators

Technical indicators are mathematical calculations based on the historical price and volume data of a security. They help traders identify patterns and trends, as well as predict future price movements.

There are two types of indicators:

Leading indicators: These indicators predict future price movements and help identify trends early (e.g., RSI, Stochastic Oscillator).

Lagging indicators: These indicators follow price movements and confirm trends once they’ve already been established (e.g., Moving Averages, MACD).

Both types of indicators have their uses, and the key is to know when and how to apply them effectively.

2. Use Moving Averages to Identify Market Trends

Moving Averages (MAs) are one of the most widely used technical indicators. They help smooth out price data to identify the direction of the trend. There are two main types:

Simple Moving Average (SMA): This is the average of prices over a specific time period (e.g., 50-day, 200-day).

Exponential Moving Average (EMA): This gives more weight to recent prices, making it more sensitive to price movements.

Moving averages are great for identifying whether the market is in an uptrend, downtrend, or sideways market. For example:

Bullish Signal: If a short-term moving average (e.g., 50-day EMA) crosses above a long-term moving average (e.g., 200-day EMA), this is a bullish signal known as the Golden Cross.

Bearish Signal: If the short-term moving average crosses below the long-term moving average, this is a bearish signal known as the Death Cross.

Moving averages help smooth out market noise and provide a clearer view of the overall market trend.

3. Use RSI to Identify Overbought or Oversold Conditions

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps identify whether an asset is overbought or oversold.

Overbought: If the RSI is above 70, it suggests that the asset might be overbought and could be due for a pullback.

Oversold: If the RSI is below 30, it indicates that the asset may be oversold and could be due for a rebound.

RSI is particularly useful for spotting potential reversals in price trends. Combine the RSI with other indicators, such as support and resistance levels, to confirm entry or exit points.

4. MACD for Trend Reversals and Momentum

The Moving Average Convergence Divergence (MACD) is a popular indicator used to identify changes in the strength, direction, and momentum of a trend.

The MACD consists of two components:

MACD Line: The difference between the 12-day and 26-day exponential moving averages.

Signal Line: A 9-day EMA of the MACD line.

Key MACD signals:

Bullish Signal: When the MACD line crosses above the signal line, it indicates upward momentum.

Bearish Signal: When the MACD line crosses below the signal line, it signals downward momentum.

Divergence: If the price moves in the opposite direction of the MACD, it could indicate a potential trend reversal.

The MACD is useful for identifying trend reversals and confirming the strength of a trend.

5. Stochastic Oscillator to Spot Overbought/Oversold Conditions

The Stochastic Oscillator is another momentum indicator that helps identify overbought and oversold conditions, much like the RSI. It compares a security's closing price to its price range over a specific time period (usually 14 days).

The Stochastic Oscillator has two lines:

%K Line: The main line that fluctuates between 0 and 100.

%D Line: A moving average of the %K line, usually set to 3 periods.

Overbought: When the %K line is above 80, the market may be overbought.

Oversold: When the %K line is below 20, the market may be oversold.

The Stochastic Oscillator is a great tool for spotting potential reversals when the market is overextended in either direction.

6. Combining Indicators for Better Accuracy

No single indicator should be used in isolation. Combining multiple indicators allows you to confirm signals and increase the accuracy of your trade decisions.

For example:

Moving averages can help identify the trend direction.

RSI can help determine if an asset is overbought or oversold.

MACD can help confirm momentum and possible trend reversals.

Using these indicators together increases the probability of a successful trade, providing a clearer and more reliable picture of market conditions.

Final Thought: Technical Indicators Can Enhance Your Strategy

Technical indicators are invaluable tools that can enhance your trading strategy. By understanding how each indicator works and using them in combination, you can make more informed decisions and improve your chances of success in the market.

Ready to trade smarter with expert-backed strategies? Download Univest — the SEBI-registered trading app that helps you analyze the market with real-time alerts and expert-curated trade ideas. Utilize technical indicators, manage risk, and trade with confidence.

0 notes

Text

The Role of Moving Averages in Technical Stocks Analysis

In the world of financial markets, technical stocks are often the focal point for investors looking to capitalize on short-term price movements. These stocks are typically analyzed using charts, patterns, and indicators to predict future trends. While some investors focus on the fundamental aspects of a company, others prefer the approach of reading price movements and volume trends, which can offer valuable insights into potential buying or selling opportunities. By understanding the behaviors and signals within technical stocks, investors can position themselves effectively in volatile markets.

The Role of Technical Analysis in Trading

Technical analysis plays a crucial role in understanding technical stocks. By examining past market data, such as price and volume, traders aim to forecast the direction of stock prices. This method contrasts with fundamental analysis, which focuses on the financial health and earnings potential of companies. Charts and patterns such as head-and-shoulders, moving averages, and resistance levels are central to predicting price fluctuations. For many, technical analysis offers a quicker, more dynamic method of analyzing stock performance, especially in fast-moving markets.

Key Indicators to Watch in Technical Stocks

There are several key indicators used to assess technical stocks. Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), are popular tools that smooth out price data over a given period. These averages help identify the general trend of a stock. Relative Strength Index (RSI) is another important indicator, measuring whether a stock is overbought or oversold. In addition, Bollinger Bands, MACD (Moving Average Convergence Divergence), and stochastic oscillators can provide further insights into market sentiment and potential price action.

Market Sentiment and Psychological Factors

One of the core principles behind technical stocks is market sentiment, which is influenced by collective behavior. Often, stock prices react not just to company performance but also to the broader psychology of the market. Investors’ reactions to news, economic data, or geopolitical events can create price volatility. As stock prices fluctuate, psychological factors like fear and greed drive the sentiment, which technical analysts try to predict by observing patterns in price charts. This makes technical stocks more responsive to market psychology than to the underlying fundamentals of the company.

The Importance of Timing in Technical Stocks

For those engaged in trading technical stocks, timing is everything. The goal is to enter and exit the market at the right moment based on trends and signals observed in the data. Traders rely on technical charts to pinpoint price levels that represent potential support (a price level where the stock tends to stop falling) and resistance (a level where the stock tends to stop rising). By identifying these levels, traders can make informed decisions about when to buy and sell, hoping to capitalize on price movements.

Volatility and Risk in Technical Stocks

One of the defining characteristics of technical stocks is their inherent volatility. Because these stocks are often influenced by short-term trends and market sentiment, their prices can fluctuate significantly. While volatility presents opportunities for traders, it also introduces risk. Stocks that are heavily traded or that have a high beta (a measure of stock price volatility relative to the market) may be more susceptible to sharp price movements. This makes technical stocks both enticing and risky, depending on an investor’s ability to manage volatility.

Long-Term vs. Short-Term Trading in Technical Stocks

While technical analysis is typically associated with short-term trading, it is also applicable to long-term strategies. For short-term traders, the focus is on capitalizing on daily or weekly price movements, often engaging in day trading or swing trading. For long-term traders, the focus may shift towards identifying key trends and patterns that can influence stock performance over months or years. Understanding how technical stocks behave in both short-term and long-term contexts can provide a more comprehensive approach to trading and investing.

Technology’s Role in Analyzing Technical Stocks

Advancements in technology have significantly improved the ability to analyze technical stocks. Algorithmic trading, artificial intelligence, and machine learning models now play a central role in analyzing vast amounts of market data. These technologies can scan for patterns across thousands of stocks, identifying trends that may not be visible to the naked eye. As a result, traders can make quicker, more informed decisions based on a more sophisticated understanding of market behavior.

The Future of Technical Stocks in a Changing Market

As the financial market evolves, the role of technical stocks continues to expand. With more investors relying on real-time data and technical analysis, these stocks will likely remain a focal point for those looking to profit from market fluctuations. However, the increasing sophistication of financial technology may lead to new challenges and opportunities for traders. Adapting to these changes will require a deeper understanding of both technical analysis and the broader market forces at play.

Technical stocks remain a cornerstone of trading strategies for those who seek to capitalize on short-term price movements and market trends. By focusing on price charts, patterns, and key technical indicators, investors can gain valuable insights into stock behavior. However, like all investments, these stocks come with risks, especially due to market volatility and psychological factors. Understanding how to navigate these dynamics is essential for anyone looking to succeed in the world of technical stocks.

0 notes